Market growth is anchored in regulatory enforcement, product integrity requirements, and evidence-based packaging approval systems across global industries.

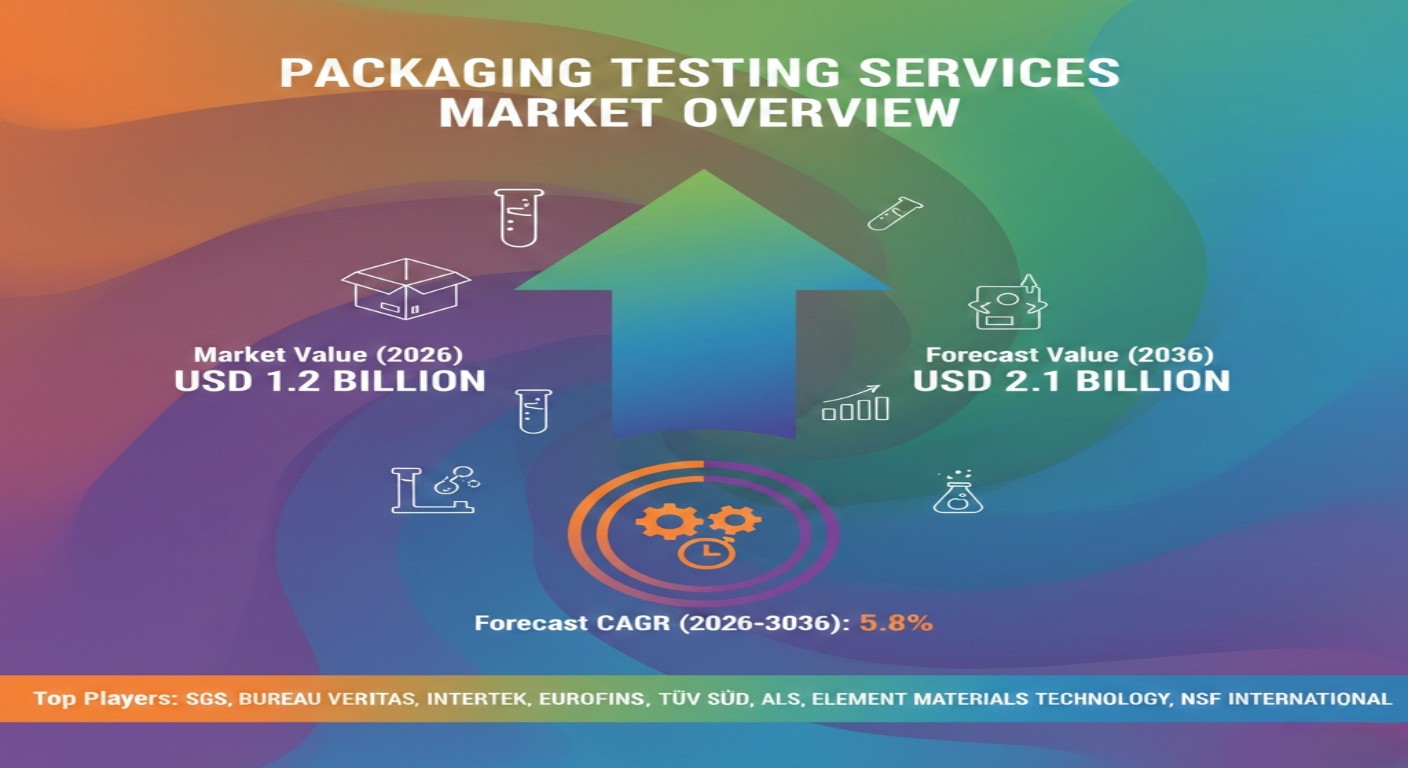

NEWARK, DE, UNITED STATES, February 17, 2026 /EINPresswire.com/ — The global packaging testing services market is projected to grow from USD 1.2 billion in 2026 to USD 2.1 billion by 2036, registering a compound annual growth rate (CAGR) of 5.8%. The expansion reflects increasing reliance on formal testing frameworks to validate packaging performance, ensure regulatory compliance, and mitigate product liability risks across food, beverage, pharmaceutical, and consumer goods sectors.

The market operates within structured quality and regulatory systems, where packaging approval depends on documented evidence covering barrier performance, migration limits, mechanical integrity, and shelf-life behavior. As packaging formats evolve and material innovations expand, testing has become a critical requirement before market release, rather than a final-stage validation step.

Unlock Growth Potential – Request Your Sample Now and Explore Market Opportunities!

https://www.futuremarketinsights.com/reports/sample/rep-gb-11147

Market Overview: Evidence-Based Validation Drives Packaging Approval

Packaging testing services are integral to product governance, where brand owners and converters define testing scope based on regulatory requirements and operational conditions. Test programs typically assess oxygen and moisture transmission, compression resistance, seal strength, drop response, and compatibility with filling and distribution environments.

Once a packaging design is approved, any modification in material or structure triggers renewed testing programs and documentation updates. This creates a recurring demand cycle tied to product changes, regulatory reviews, and portfolio expansions.

Key Market Highlights

• Market Value (2026): USD 1.2 billion

• Forecast Value (2036): USD 2.1 billion

• CAGR (2026–2036): 5.8%

• Leading Service Type: Physical testing (38% share)

• Leading End Use: Food and beverage (42% share)

• Key Growth Markets: China, India, United States, Germany, Japan

Regulatory Compliance and Risk Management Shape Demand

Demand for packaging testing services is primarily driven by regulatory scrutiny, recall risk, and brand protection requirements. Companies increasingly require independent verification that packaging can withstand transport, protect contents, and maintain compliance across multiple markets.

Testing is embedded within shipment approval processes rather than limited to design validation. Regulatory compliance testing, migration analysis, and shelf-life studies are used to prevent late-stage failures, product recalls, and distribution disruptions.

Packaging testing now functions as a risk management tool, where failure to meet compliance standards can result in shipment holds, financial penalties, and reputational damage. As a result, testing decisions are governed by quality and regulatory teams rather than procurement functions.

Physical Testing Leads Due to Direct Impact on Product Integrity

Physical testing accounts for approximately 38% of total market demand, reflecting its critical role in verifying mechanical performance under real-world conditions. Tests such as compression resistance, drop simulation, vibration analysis, and seal integrity are essential to ensure packaging durability throughout distribution and storage.

Mechanical performance directly influences leakage risk, product damage, and shelf presentation, making physical testing the first stage of validation in most packaging programs. Engineering, operations, and quality teams rely on these tests to monitor transport damage rates, production consistency, and complaint patterns.

Food and Beverage Sector Dominates Testing Demand

The food and beverage segment represents approximately 42% of total demand, driven by direct ingestion risk, strict regulatory oversight, and low tolerance for product failure. Packaging performance in this sector is closely tied to spoilage prevention, contamination control, and brand trust.

Pharmaceutical applications require deeper documentation and traceability but operate at lower volumes. Personal care and cosmetics focus on long-term stability and compatibility, while electronics packaging emphasizes protection against shock and moisture.

Demand concentration in food and beverage reflects the sector’s high exposure to regulatory enforcement, consumer safety concerns, and large-scale production environments.

Market Structure: Accreditation and Method Consistency Drive Participation

Participation in the packaging testing services market depends on accreditation status, regulatory recognition, and acceptance by brand owners. Access to projects is typically controlled through approved laboratory lists, where suppliers must demonstrate compliance with established testing standards.

Test protocols remain consistent over long product cycles, as regulatory filings and quality systems reference specific methods. Supplier changes occur primarily during audit cycles or requalification processes rather than routine procurement decisions.

Regional Outlook: Asia Pacific Leads Growth Momentum

Growth trends vary across regions, reflecting differences in regulatory frameworks, manufacturing scale, and packaging adoption:

• China (6.2% CAGR): Growth driven by e-commerce expansion, high-volume logistics, and adoption of standardized testing protocols.

• India (5.9% CAGR): Expansion supported by increasing packaged goods production and regulatory requirements for quality verification.

• United States (5.7% CAGR): Demand shaped by corporate compliance programs and standardized testing systems.

• Germany (5.4% CAGR): Growth influenced by strict safety regulations and multi-line quality verification requirements.

• Japan (5.2% CAGR): Mature market focused on consistency, certification, and food-contact compliance.

Asia Pacific remains a key growth region, supported by manufacturing expansion, rising regulatory enforcement, and increased adoption of packaging validation systems.

Competitive Landscape: Focus on Accuracy, Reproducibility, and Compliance

The market includes global testing and certification providers such as SGS SA, Bureau Veritas S.A., Intertek Group plc, Eurofins Scientific SE, TÜV SÜD AG, ALS Limited, Element Materials Technology, and NSF International.

Competition is defined by:

• Test reproducibility and analytical accuracy

• Breadth of method coverage

• Compliance with regulatory frameworks

• Technical support and integration capabilities

Suppliers that provide consistent results, scalable services, and reliable documentation gain preference in long-term contracts and multi-year service agreements.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Have a Look at Related Research Reports on the Packaging Domain:

Composite Paper Cans Market https://www.futuremarketinsights.com/reports/composite-paper-cans-market

CPLA for Packaging Market https://www.futuremarketinsights.com/reports/cpla-for-packaging-market

Foil Labels Market https://www.futuremarketinsights.com/reports/foil-labels-market

Track And Trace Packaging https://www.futuremarketinsights.com/reports/track-and-trace-packaging-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()