San Antonio, TX / Storyteller / Feb 16, 2026 /

The One Big Beautiful Bill Act, signed into law July 4, 2025, permanently eliminates the Section 179D deduction for architecture and engineering firms, also known as the Section 179D Energy Efficient Commercial Building Deduction, for any construction project that begins after June 30, 2026. For architecture and engineering firms that have designed energy-efficient government buildings, public schools, or nonprofit facilities at any point since 2006, this deadline represents the final opportunity to claim deductions worth up to $5.81 per square foot—deductions that, for a single 100,000 square foot government project, translate to approximately $167,000 in federal tax savings.

Sunbridge Advisory, a San Antonio-based accounting firm serving architecture, engineering, and construction firms nationwide, is raising awareness that the vast majority of eligible A&E firms have never claimed these deductions; not because they don’t qualify, but because their accountants have never encountered the designer allocation mechanism that makes the deduction available to design professionals rather than building owners. For firms operating across multiple jurisdictions, the complexity of multi-state tax compliance for architecture firms further obscures the opportunity, as state apportionment and varying conformity to federal tax provisions often divert attention from specialized federal incentives like Section 179D.

A Knowledge Gap Worth Hundreds of Thousands

Section 179D was originally designed as a building owner deduction. However, because government agencies, public schools, and nonprofit organizations are tax-exempt, the tax code allows these entities to allocate the deduction to the designer of the building’s energy-efficient systems; that’s typically the architecture or engineering firm. The building owner must provide a formal allocation letter assigning the deduction to the designer, a step that government agencies will not initiate on their own because they derive no tax benefit from it.

This creates a structural problem: the firm that qualifies for the deduction doesn’t know it exists, and the entity that controls the allocation letter has no incentive to offer it. Meanwhile, generalist CPAs who prepare taxes for architecture firms typically understand 179D as a building owner provision and don’t ask whether their clients have designed qualifying government buildings.

“The standard tax interview for an architecture firm doesn’t ask about the energy performance of government buildings you’ve designed,” said Lévi Kedowide, CPA and Partner at Sunbridge Advisory LLC. “It asks about revenue, expenses, and payroll. If your accountant hasn’t worked extensively with A&E firms, the deduction never makes it onto your radar. We’ve seen firms that designed three or four qualifying buildings over the past decade and left $250,000 or more in deductions on the table simply because no one thought to request the allocation letters.”

What the One Big Beautiful Bill Changed

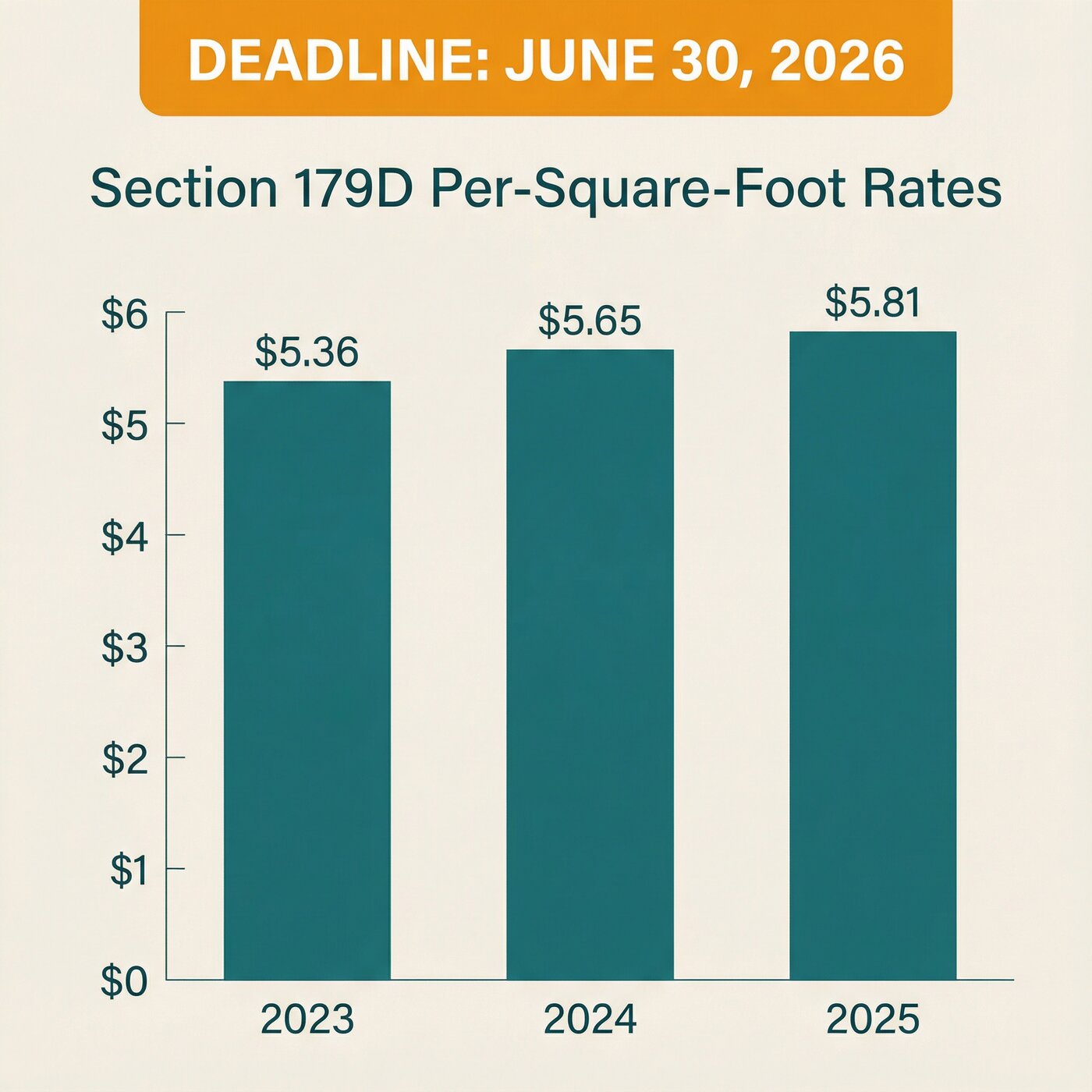

Prior to July 2025, Section 179D was a permanent provision of the tax code with no expiration date. The Inflation Reduction Act of 2022 had significantly increased the maximum deduction rates – from $1.88 per square foot to as much as $5.36 per square foot for 2023 projects, $5.65 for 2024 projects, and $5.81 for 2025 projects – making the deduction substantially more valuable for qualifying firms.

The One Big Beautiful Bill Act reversed this trajectory entirely. The legislation terminates Section 179D for any project that begins construction after June 30, 2026. This is not a temporary suspension or a phase-down—it is a permanent elimination of the deduction. Projects that have already begun construction or been placed in service remain eligible, but no new projects will qualify after the deadline.

The Retroactive Claim Window Is Also Closing

Firms can claim missed Section 179D deductions by amending prior-year tax returns, but only within three years of the original return’s due date. As of February 2026, the open tax years for amended returns are 2022, 2023, and 2024. The 2022 amendment deadline arrives in April 2026 for firms that filed on extension, meaning firms that completed qualifying government projects in 2022 have approximately two months to identify those projects, request allocation letters from building owners, complete energy modeling certification, and file amended returns.

Government agencies typically require six to twelve months to process allocation letter requests, which means firms requesting letters now for 2022 projects may not receive them before the amendment window closes. Sunbridge Advisory advises firms to prioritize 2023 and 2024 projects where the amendment timeline is more realistic while simultaneously initiating requests for any 2022 projects.

Quantifying the Impact

The financial impact scales directly with project size. A 50,000 square foot municipal building designed in 2024 that achieves 50% energy savings generates a $282,500 deduction. A 250,000 square foot university building produces a $1.4 million deduction. At a 29.6% effective federal tax rate, factoring in the 20% Qualified Business Income deduction available to most pass-through architecture firms, these translate to approximately $83,600 and $414,400 in actual tax savings, respectively.

Buildings must achieve specific energy savings thresholds to qualify: 25% energy reduction relative to ASHRAE 90.1 baseline standards for partial deductions, and 50% for the maximum rate. Projects that were designed to meet LEED certification, net-zero energy standards, or aggressive energy budgets specified in the owner’s project requirements are the most likely to qualify. Buildings designed only to minimum code compliance typically do not meet the threshold.

“The firms most likely to benefit are the ones least likely to know about this,” Kedowide added. “Small and mid-sized architecture firms that have done government work—courthouses, fire stations, school buildings, VA facilities—and whose CPA is a generalist. The larger firms with Big Four accountants tend to have this on their radar already. It’s the 5-to-20-person firms that are consistently leaving money on the table.”

What Architecture and Engineering Firms Should Do Now

Sunbridge Advisory recommends that architecture and engineering firms take three immediate steps. First, conduct a project inventory of all government, public school, and nonprofit building projects completed since 2006 where the firm provided design services for HVAC, lighting, building envelope, or hot water systems. Second, identify which of those projects were designed to achieve energy performance beyond minimum code requirements – LEED-certified projects, net-zero buildings, and projects with explicit energy performance criteria in the owner’s requirements are priority candidates. Third, initiate allocation letter requests with building owners as early as possible, because government processing timelines are the primary bottleneck in the entire claim process.

A detailed procedural guide covering the full Section 179D claim process – including project screening criteria, allocation letter templates, energy modeling requirements, and filing procedures – is available on the Sunbridge Advisory website at sunbridgetx.com.

About Sunbridge Advisory

Sunbridge Advisory is an accounting firm providing monthly close, outsourced controllership, and proactive tax planning for architecture firms, engineering firms, and construction firms. The firm has more than 20 years of experience and is operated by leadership with backgrounds from EY and McKinsey. Sunbridge serves over 300 clients and 200 business owners rely on its accounting and tax services. The firm is headquartered in San Antonio, Texas and serves AEC firms nationwide.

For more information, visit sunbridgetx.com or call (210) 492-1627.

###

Media Contact

Lévi Kedowide, CPA

Sunbridge Advisory

(210) 492-1627

sunbridgetx.com

newsroom: news.38digitalmarket.com