Bulk packaging for computer peripherals shifts to reusable, automation-ready systems as supply chains prioritize efficiency, compliance, and sustainability.

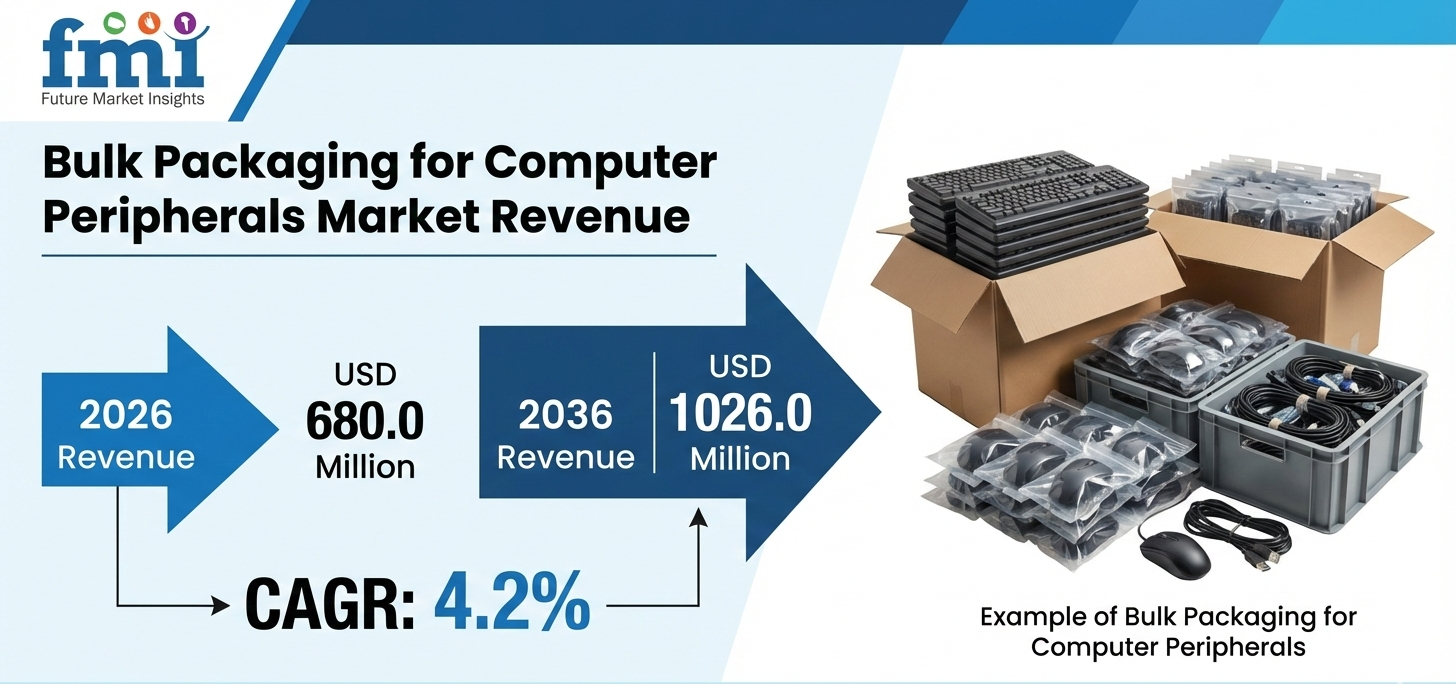

NEWARK, DE, UNITED STATES, February 13, 2026 /EINPresswire.com/ — The global electronics logistics ecosystem is entering a structural reset. As manufacturing footprints decentralize and automation intensifies across distribution hubs, the Bulk Packaging for Computer Peripherals Market—valued at USD 680.0 million in 2026—is projected to reach USD 1,026.0 million by 2036, expanding at a steady CAGR of 4.2%.

According to the latest industry outlook from Future Market Insights (FMI), growth is no longer anchored in simple corrugated transit boxes. Instead, it is being propelled by the systemic shift toward intelligent, reusable, and automation-compatible bulk packaging platforms engineered for supply chain resilience and regulatory compliance.

The Logistics Pivot: From Disposable Shippers to System Assets

For decades, bulk packaging in electronics served as a cost center—optimized primarily for protection and price. In 2026, that narrative has evolved.

Bulk packaging is now treated as a performance-critical logistics asset. OEMs and contract manufacturers are prioritizing:

• Returnable plastic tote systems

• RFID-embedded corrugated shippers

• Collapsible bulk containers for reverse logistics

• Unit-load optimized pallet configurations

• Packaging data integration with warehouse management systems

In January 2026, HP Inc. announced a multi-year partnership with Southeast Asian contract manufacturers mandating standardized returnable tote systems for intra-factory movement of keyboards and mice. The initiative aims to eliminate 300 metric tons of annual corrugated waste by 2028—illustrating how sustainability and operational efficiency are converging.

Engineering Density: Packaging as a Freight Optimization Tool

Freight volatility continues to reshape cost structures across global trade lanes. As highlighted in the 2026 State of Logistics Report by the Council of Supply Chain Management Professionals, dimensional weight optimization has emerged as a top-three lever for cost control in high-volume electronics logistics.

This has elevated packaging density to a boardroom-level KPI.

In Q1 2026, Smurfit Kappa launched its “Performance Wave” corrugated shipper series featuring embedded RFID tags and compression-engineered walls. The innovation enables up to 15% higher pallet load density for peripherals—directly addressing freight capacity constraints.

Meanwhile, Sealed Air Corporation consolidated manufacturing assets in late 2025 to scale production of engineered cushioning systems compatible with automated sortation lines used by major third-party logistics providers.

Bulk packaging is no longer passive containment—it is active infrastructure within automated distribution networks.

Regional Realignment: Asia-Pacific Leads, Nearshoring Gains Pace

Electronics manufacturing realignment is reshaping packaging demand geography.

• Asia-Pacific (44% share) leads due to its concentration of contract manufacturing hubs.

• North America (24% share) benefits from sophisticated e-commerce fulfillment networks.

• Europe (22% share) is driven by aggressive industrial packaging reuse mandates.

India is emerging as a high-growth corridor. The country’s Production Linked Incentive (PLI) scheme has catalyzed domestic peripheral manufacturing, while stricter plastic waste regulations are accelerating adoption of recyclable corrugated bulk systems.

Vietnam’s export-driven ecosystem is also pushing packaging suppliers to meet high recycled-content and certification requirements aligned with multinational OEM mandates.

Regulatory Pressure: Compliance as Growth Catalyst

The United States Environmental Protection Agency updated its Waste Reduction Model (WARM) in 2026 to include enhanced emission factors for reusable industrial packaging. This quantification strengthens the financial case for multi-trip systems.

In Europe, the Packaging and Packaging Waste Regulation (PPWR) introduces reuse targets for transport packaging used within industrial operations, compelling large OEMs to transition toward certified returnable tote pools.

Simultaneously, digital product passport requirements are driving integration of master-level QR codes and RFID tags into bulk containers—transforming them into traceable data nodes across supply chains.

Format Dynamics: Corrugated Dominates, Reusables Accelerate

Corrugated master shippers remain the workhorse of the industry, accounting for 52% of bulk pack types. Their cost efficiency, strength-to-weight ratio, and print compatibility sustain dominance in discrete product distribution.

However, returnable plastic totes and collapsible container systems are expanding rapidly in closed-loop manufacturing environments. Companies are investing in pallet pooling and asset tracking platforms to reduce total cost of ownership across multi-trip cycles.

The cables and adapters category—holding a 26% share—continues to drive specialized packaging innovation focused on tangle prevention, accurate counting, and automated dispensing.

Market Snapshot (2026–2036)

• Market Value (2026): USD 680.0 Million

• Forecast Value (2036): USD 1,026.0 Million

• Projected CAGR: 4.2%

• Leading Region: Asia-Pacific (44% Share)

• Core Growth Driver: Automation compatibility & reusable systems

Competitive Landscape: Data-Driven Packaging Ecosystems

The competitive environment favors integrated service providers capable of offering lifecycle management, asset tracking, reverse logistics, and compliance documentation.

Global players such as International Paper, WestRock, Amcor, and Sonoco are expanding portfolios beyond corrugate manufacturing into reusable systems and digital asset management platforms.

In February 2026, Smurfit Kappa announced a joint venture to launch a digital packaging asset management platform, signaling the sector’s pivot toward packaging-as-a-service models.

Barriers to entry are rising, as OEM vendor certification programs now require compliance with drop-test standards, humidity endurance metrics, and automation compatibility benchmarks.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-31974

The Outlook: From Brown Box to Intelligent Infrastructure

By 2036, bulk packaging for computer peripherals will no longer be viewed as a disposable transport necessity. It will be embedded into the operational fabric of electronics manufacturing and distribution.

As contract manufacturing scales, nearshoring accelerates, and warehouse automation deepens, bulk packaging is evolving into a data-enabled, reusable, and system-critical component of industrial logistics architecture.

In a supply chain environment where resilience, traceability, and sustainability define competitive advantage, bulk packaging has quietly moved from the periphery to the center of strategic decision-making.

Browse Related Insights

Bulk Chemical Packaging Market: https://www.futuremarketinsights.com/reports/industrial-bulk-chemical-packaging-market

Bulk Container Packaging Market: https://www.futuremarketinsights.com/reports/bulk-container-packaging-market

Bulk Liquid Transport Packaging Market: https://www.futuremarketinsights.com/reports/bulk-liquid-transport-packaging-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()