Internet of Things (IoT) Market Size, Connected Device Trends, and Forecast 2026–2034

PUNE, MAHARASHTRA, INDIA, February 10, 2026 /EINPresswire.com/ — Internet of Things Market Overview Analysis

The global Internet of Things market demonstrates extraordinary expansion driven by accelerating smart city adoption, technological convergence, and increasing enterprise digital transformation initiatives. Comprehensive analysis reveals robust growth trajectories across diverse industry verticals and geographic markets through 2032.

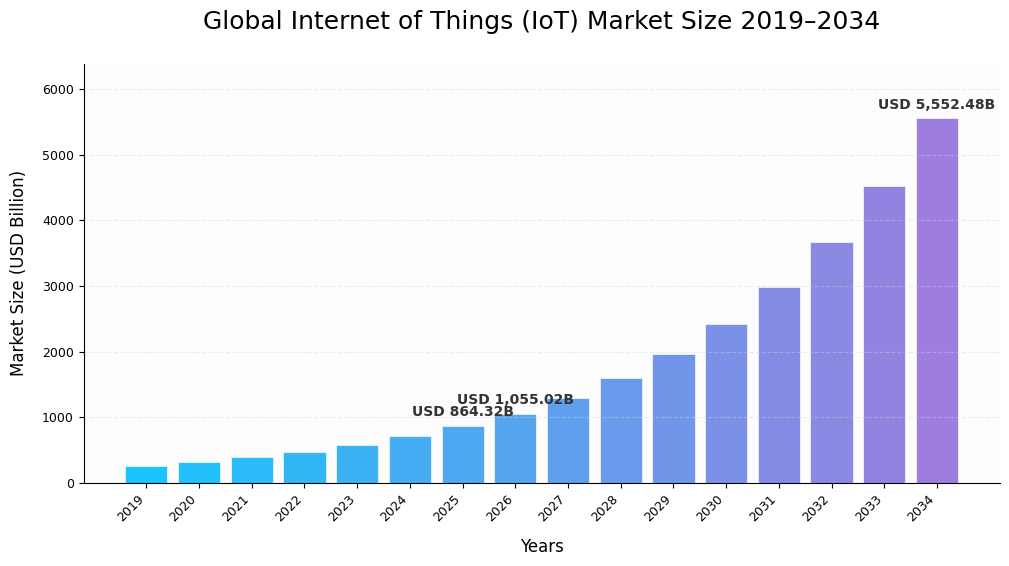

Market Valuation and Growth Projections

The global Internet of Things (IoT) market size was valued at USD 864.32 billion in 2025. The market is projected to grow from USD 1,055.02 billion in 2026 to USD 5,552.48 billion by 2034, exhibiting a CAGR of 23.10% during the forecast period. North America dominated the Internet of Things (IoT) market with a market share of 32.40% in 2025.

Request a Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/internet-of-things-iot-market-100307

Component Segmentation and Technology Integration

Solutions and services dominate market composition, capturing 72.20% market share in 2024, as industries implement intelligent systems to enhance existing infrastructure. Healthcare facilities deploy connected devices to improve medical outcomes, while manufacturing operations leverage IoT for predictive maintenance and supply chain optimization. The platform segment demonstrates accelerated growth driven by increasing demand for effective data server connectivity and enterprise application integration, with network management projected to hold 54.10% platform share in 2025.

Cloud platforms exhibit particularly strong momentum with anticipated 29.50% CAGR during the forecast period, reflecting industry migration toward scalable infrastructure supporting advanced analytics capabilities. Integration of artificial intelligence and machine learning services within cloud-based IoT deployments enables predictive maintenance, anomaly detection, and system optimization, enhancing decision-making processes and driving innovation across sectors.

Network management solutions gain traction through businesses’ growing demand for remote monitoring systems and internet-enabled devices. These solutions offer device-independent functionality while seamlessly integrating cross-vendor hardware models into operational workflows, addressing enterprise requirements for unified device management across heterogeneous technology environments.

Deployment Models and Infrastructure Strategies

Cloud deployment captures 60.50% market share in 2025, projected to expand at substantial 26.40% CAGR during the forecast period. Cloud infrastructure remains crucial for IoT data processing and advanced analytics, with growing integration of edge computing capabilities addressing latency-sensitive applications. Organizations leverage cloud platforms’ AI and machine learning services to derive actionable insights from IoT data, enabling enhanced operational efficiency and customer experience optimization.

On-premise deployments maintain relevance particularly for organizations with stringent data sovereignty requirements, latency-sensitive applications, or limited cloud connectivity. These deployments address specific regulatory compliance needs while unlocking IoT potential for operational efficiency improvements. Organizations with sensitive data handling requirements or specialized operational constraints benefit from on-premise infrastructure control and customization capabilities.

Enterprise Adoption Patterns

Large enterprises command 87.10% market share in 2025, implementing comprehensive end-to-end IoT solutions integrated with existing enterprise resource planning and customer relationship management systems. These organizations possess resources necessary for sophisticated IoT deployments spanning multiple facilities and geographies, deriving enterprise-wide insights and operational improvements.

Small and medium-sized enterprises demonstrate highest growth rate at 27.00% CAGR during forecast period, adopting cost-effective, easily deployable IoT solutions addressing immediate business needs. SMEs prioritize applications including remote equipment monitoring, inventory management, and environmental monitoring, seeking accessible entry points into IoT technology without substantial capital investments. This segment’s growth reflects increasing availability of affordable IoT platforms and scalable deployment models.

Regional Market Dynamics

North America maintains market leadership with $232.86 billion valuation in 2024, benefiting from advanced technology infrastructure, substantial research and development investments, and prominent market player presence including Amazon Web Services, Google, Cisco, Microsoft, and IBM. The region’s healthcare, industrial, and automotive sectors experience notable growth supported by expanding cloud platform adoption and 5G technology deployment. GSMA Intelligence projects cellular IoT connections reaching 535 million by 2030 in North America, with the United States accounting for over 90% of regional connections. The U.S. market is forecast to reach $151.68 billion in 2025.

Europe represents third-largest regional market, valued at $197.79 billion in 2025, positioned to surpass North America through accelerated adoption across member states. Healthcare sector connectivity combined with big data integration drives regional momentum. The United Kingdom market continues expansion toward $47.21 billion in 2025, while Germany and France project $44.41 billion and $44.56 billion respectively. Industry projections indicate European organizations spending $345 billion on IoT-related technology by 2027, demonstrating substantial regional investment commitment.

Asia Pacific demonstrates second-largest market position at $239.63 billion in 2025, exhibiting highest regional CAGR at 28.20% during forecast period. Smart city initiatives including China’s Intelligent Disease Prediction Project and rising cloud infrastructure spending propel regional growth. Communication service providers and manufacturers including Taiwan Mobile and Samsung Electronics intensify portfolio development exploiting connected device opportunities. China’s market projects $90.32 billion valuation in 2025, while India and Japan anticipate $28.83 billion and $47.37 billion respectively.

Click for an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/internet-of-things-iot-market-100307

Emerging Technology Integration

Generative AI integration represents transformative trend reshaping IoT capabilities. Machine learning mechanisms generating synthetic data address challenges in predictive maintenance, anomaly detection, fraud prevention, and personalized recommendations. December 2023 witnessed Microsoft and TomTom unveiling generative AI for connected vehicles, introducing AI-driven conversational assistants improving voice interaction with infotainment and vehicle command systems, exemplifying technology convergence potential.

Blockchain technology adoption enhances IoT security and scalability, providing decentralized solutions for connected device networks. Blockchain-based architectures enable transparent freight tracking, component provenance verification, and automated transaction validation. December 2023 saw Vodafone and Deloitte collaboration introducing blockchain IoT services simplifying supply chain operations across energy, automotive, and manufacturing sectors.

Read More Research Reports:

5G IoT Market Size, Share & Industry Analysis

IoT Connected Machines Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()