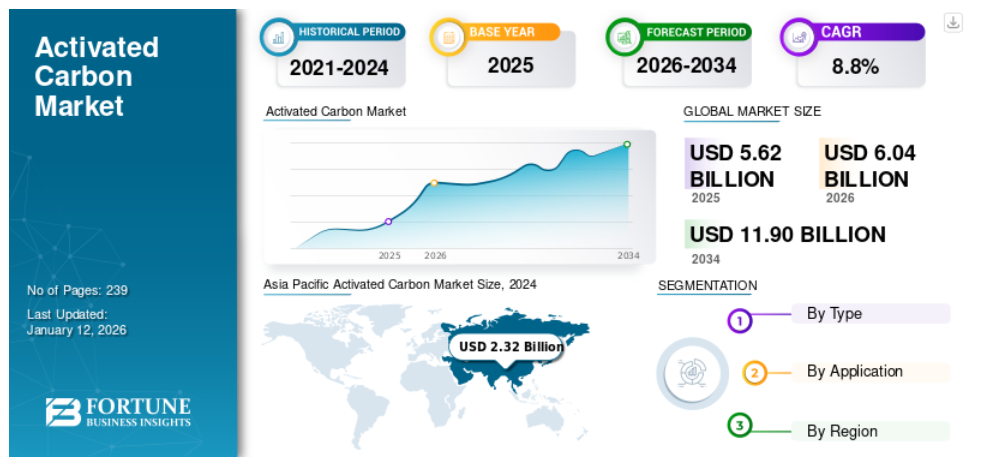

Activated Carbon Market Size to Reach USD 11.9 Billion by 2034, Supported by Environmental Regulations and Industrial Demand

PUNE, MAHARASHTRA, INDIA, February 10, 2026 /EINPresswire.com/ — The global activated carbon market size was valued at USD 5.62 billion in 2025 and is projected to grow from USD 6.04 billion in 2026 to USD 11.9 billion by 2034, exhibiting a CAGR of 8.8% during the forecast period. Asia Pacific dominated the activated carbon market with a market share of 43.95% in 2025, supported by rapid industrialization, strict environmental policies, and growing demand for water and air purification across China, India, and Southeast Asia.

The U.S. activated carbon market is projected to reach USD 2.00 billion by 2032, fueled by rising applications in water treatment, air filtration, and industrial processing, along with stringent environmental regulations.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/activated-carbon-market-102175

Activated carbon, also referred to as activated charcoal, is known for its superior adsorption properties and is widely used in air treatment, water purification, and industrial processes. Growing awareness of environmental sustainability and regulatory compliance has encouraged manufacturers to invest in advanced technologies and application-specific solutions.

Activated Carbon Market Takeaways

The market is witnessing steady growth due to rising environmental concerns, increased adoption in water and air treatment, and technological advancements in tailored pore structures. Growing demand from personal care, pharmaceutical, and food & beverage industries is further strengthening long-term market growth.

Activated Carbon Market Trends

Increasing Focus on Reactivated Carbon Emerges as a Key Market Trend

Rising consumption of activated carbon has increased the need for recycling and reactivation due to limited raw material availability. Reactivated carbon restores adsorption capacity through thermal treatment while reducing waste generation and emissions such as CO₂ and carbon monoxide. This process also helps minimize landfill usage, making reactivated carbon an increasingly preferred solution among manufacturers.

Market Dynamics

Market Drivers

Rising Demand in Air Purification Systems to Boost Market Growth

Increasing air pollution levels and industrial emissions have accelerated demand for activated carbon in air purification systems. Governments worldwide are enforcing stringent emission control policies, driving adoption of carbon filters capable of removing VOCs, SOx, NOx, mercury vapors, and hazardous gases.

Growing Use of Activated Charcoal in Personal Care Products to Support Growth

Activated charcoal is gaining rapid adoption in personal care products due to its ability to remove impurities, bacteria, toxins, and excess oil from skin and hair. Rising consumer awareness, higher disposable income, and expansion of the beauty and personal care industry are expected to further boost market growth.

Market Restraints

Raw Material Shortages and High Production Costs to Restrain Market Growth

The scarcity of raw materials such as coconut shell charcoal and rising coal prices have increased production costs. Seasonal availability, geopolitical factors, and fluctuating crude oil prices have resulted in supply chain volatility. Additionally, high manufacturing costs of premium-grade activated carbon limit adoption in cost-sensitive industries.

Trade Protectionism

Trade protection measures, including tariffs and environmental regulations such as the EU’s Carbon Border Adjustment Mechanism (CBAM), may indirectly affect activated carbon supply chains and production costs, influencing global market dynamics.

Impact of COVID-19

The COVID-19 pandemic led to reduced industrial activity and temporary shutdowns of manufacturing facilities, lowering demand for activated carbon in wastewater treatment and air filtration. However, growing awareness of water treatment and air purification, coupled with industrial recovery from 2021 onward, supported market rebound.

Activated Carbon Market Segmentation Analysis

By Type

Granular activated carbon (GAC) dominates the market due to its reusability, effective contaminant removal, and high demand from air treatment and water purification systems. The powdered activated carbon (PAC) segment is also witnessing strong growth, driven by its high adsorption efficiency in water treatment applications.

By Application

The water treatment segment dominates the market, supported by rising demand for clean drinking water and strict environmental regulations. The air & gas purification segment holds a significant share due to increasing air quality concerns. Food & beverage and pharmaceutical & healthcare applications are also expanding steadily, driven by quality and safety requirements.

Regional Outlook

Asia Pacific

Asia Pacific dominated the market and is the fastest-growing region, driven by strict environmental policies, rapid industrialization, and abundant raw material availability. China leads both production and consumption, while Japan and India continue to witness steady growth.

North America

North America is supported by stringent environmental regulations and strong demand from healthcare, pharmaceutical, and industrial sectors. The U.S. remains the dominant market in the region.

Europe

Europe represents the second-largest market, driven by sustainability regulations, water quality standards, and automotive emission control requirements. Germany, the U.K., and France are key contributors.

Latin America & Middle East & Africa

Latin America is witnessing growing demand from water purification and pharmaceutical industries, while the Middle East & Africa market is supported by low water availability, oil & gas activities, and industrial expansion.

Competitive Landscape

Key Players Focus on Sustainability and Capacity Expansion

Leading players are strengthening their market position through acquisitions, capacity expansion, and sustainable product innovations to meet growing global demand.

List of Key Activated Carbon Companies Profiled:

Osaka Gas Chemicals Co., Ltd.

Donau Carbon GmbH

Cabot Corporation

PURAGEN ACTIVATED CARBONS

CARBOTECH AC GMBH

Kuraray Co., Ltd.

Ingevity

Have Any query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/activated-carbon-market-102175

Key Industry Developments

May 2024: Kuraray Co., Ltd. and its U.S. subsidiary Calgon Carbon Corporation announced plans to acquire Sprint Environmental Services’ reactivated carbon business.

March 2023: Cabot Corporation launched its EVOLVE technology program to advance sustainable carbon recovery.

January 2023: Cabot Corporation announced a USD 200 million investment to expand conductive carbon capacity in Texas, U.S.

October 2022: Kuraray completed test operations at its reactivated carbon facility in Germany.

August 2022: Ingevity invested USD 60 million in lithium-ion anode materials to secure long-term activated carbon supply.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()