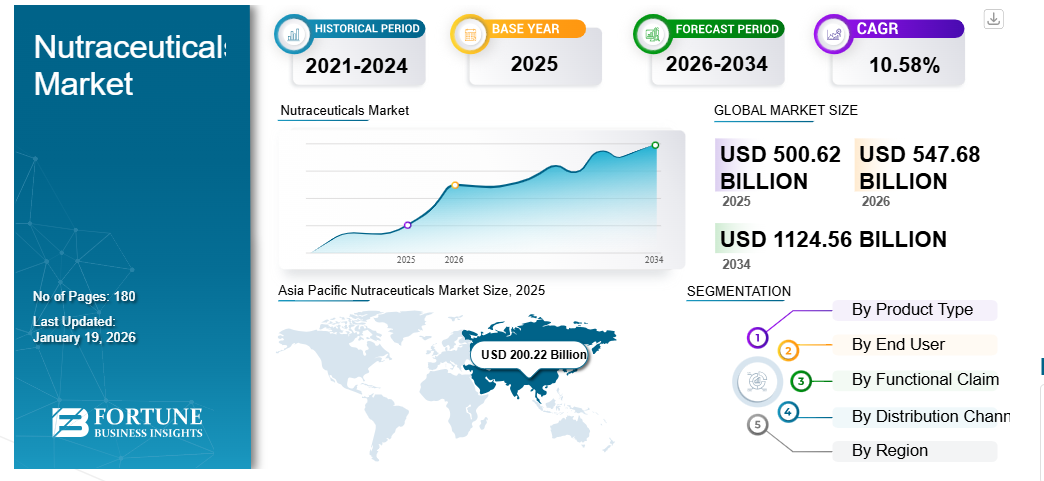

Nutraceuticals Market Size to Reach USD 1,124.56 Billion by 2034, Supported by Preventive Healthcare Trends and Functional Nutrition Demand

PUNE, MAHARASHTRA, INDIA, February 10, 2026 /EINPresswire.com/ — The global nutraceuticals market size was valued at USD 500.62 billion in 2025 and is projected to grow from USD 547.68 billion in 2026 to USD 1,124.56 billion by 2034, exhibiting a CAGR of 10.58% during the forecast period. Asia Pacific dominated the nutraceuticals market with a market share of 39.99% in 2025, supported by rising population, increasing disposable income, and growing awareness of health and wellness across emerging economies.

Nutraceuticals are gaining widespread acceptance as consumers increasingly recognize their ability to prevent or delay health conditions and support overall well-being. Growing inclination toward natural and alternative healthcare approaches, coupled with rising demand for functional and fortified products, continues to accelerate global market growth.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/nutraceuticals-market-102530

Global Nutraceuticals Market Takeaways

The market is witnessing sustained growth due to rising health consciousness, increased spending on preventive healthcare, and expanding demand for functional foods, beverages, and dietary supplements. Digital transformation of supply chains, celebrity-backed promotions, and expansion of e-commerce platforms are strengthening long-term growth prospects.

Nutraceuticals Market Trends

Personalized Nutrition Emerges as a Key Growth Trend

Personalized nutrition is gaining strong momentum, driven by consumer preference for customized supplements, diets, and wellness solutions. Evidence-based, clean-label, and targeted nutritional offerings are increasingly replacing one-size-fits-all products. Nutritional supplements are emerging as key tools in proactive and preventive healthcare, supporting steady nutraceuticals market growth.

Market Dynamics

Market Drivers

Rising Popularity of Nutrient-Enriched Diets

Improved healthcare access, declining mortality rates, and increased consumer spending on health and wellness have boosted demand for nutraceutical products globally. Functional foods and beverages are increasingly preferred as convenient sources of concentrated nutrition.

During the COVID-19 pandemic, awareness regarding immune health surged significantly. For instance, in September 2020, the Indian government launched eight nutraceutical products under the Pradhan Mantri Bhartiya Janaushadhi Pariyojana, aimed at improving immunity among consumers.

Growing Investments in Technological Advancements

High investments in research and development are enabling manufacturers to introduce innovative functional beverages and dietary supplements. Rising concerns over antibiotic resistance and overall immunity are encouraging the development of nutraceutical products that support gut microbiota diversity and holistic health.

Market Restraints

Stringent Regulatory Frameworks Limit Market Expansion

Despite strong demand, the nutraceuticals market faces challenges due to complex and inconsistent regulatory structures across regions. Lack of harmonized standards for ingredients, dosage limits, and health claims complicates commercialization and slows product approvals in several markets.

Market Opportunities

Shift Toward Preventive Healthcare Creates New Growth Avenues

Rising healthcare costs are driving consumers to adopt nutraceuticals as preventive solutions rather than reactive treatments. This shift is increasing demand for vitamins, minerals, gut-health products, cognitive health supplements, and stress-management solutions, offering significant growth opportunities for manufacturers.

Market Challenges

Limited Quality Control Standards Impact Consumer Trust

Unlike pharmaceuticals, nutraceuticals face limited standardization and quality control requirements in many regions. Variations in product quality can undermine consumer confidence and pose challenges for long-term market credibility.

Nutraceuticals Market Segmentation Analysis

By Product Type

Functional Beverages Lead Market Demand

The market is segmented into dietary supplements, functional foods, and functional beverages. Functional beverages are projected to account for 42.06% of the market share in 2026, driven by consumer shift from sugary drinks toward low-calorie, nutrient-fortified beverages.

Functional foods support anemia prevention, bone health, and dietary deficiency management, while dietary supplements continue to expand due to capacity expansions by key manufacturers.

By End User

Lifestyle Users Dominate Due to Preventive Healthcare Spending

Lifestyle users are expected to hold 28.01% of the market share, driven by higher awareness of balanced living and preventive nutrition. Geriatric users represent the second-largest segment due to higher susceptibility to nutrient deficiencies, followed by athletes and fitness enthusiasts seeking performance and recovery benefits.

By Functional Claim

High/Added Fiber Products Hold the Largest Share

High/added fiber products are anticipated to hold 26.78% of the market share, supported by benefits related to digestive health, gut health, and blood sugar regulation. Added protein products are expected to register the fastest growth due to increasing focus on muscle health and overall nutrition.

By Distribution Channel

Supermarkets/Hypermarkets Remain the Preferred Retail Channel

Supermarkets and hypermarkets are forecast to account for 43.05% of total market share, driven by high consumer reliance on physical retail for food and wellness purchases. Online retail is also expanding rapidly due to convenience, discounts, and broader product availability.

Nutraceuticals Market Regional Outlook

Asia Pacific

Asia Pacific dominated the market, valued at USD 200.22 billion in 2025, supported by population growth, rising income levels, and growing health awareness. Japan, China, and India are projected to reach USD 48.65 billion, USD 80.31 billion, and USD 37.50 billion by 2026, respectively.

North America

North America holds the second-largest market share, driven by high demand for dietary supplements and functional beverages. The U.S. market is projected to reach USD 94.17 billion by 2026, supported by obesity management, healthy aging trends, and preventive healthcare adoption.

Europe

Europe’s growth is driven by an aging population and increasing preference for preventive healthcare. The UK and Germany markets are projected to reach USD 24.42 billion and USD 21.81 billion by 2026, respectively.

South America & Middle East & Africa

South America currently accounts for approximately 12% of global turnover but holds strong growth potential. The Middle East & Africa market is expanding due to rising healthcare spending, income growth, and increasing investments by global nutraceutical companies.

Have Any query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/nutraceuticals-market-102530

Competitive Landscape

Product Innovation and Portfolio Expansion Drive Competition

The nutraceuticals market is moderately consolidated, with key players focusing on product launches, portfolio expansion, and geographic growth.

List of Key Nutraceuticals Companies Profiled:

Herbalife Nutrition Ltd.

Archer Daniels Midland Company

General Mills

PepsiCo Inc.

Abbott

Amway

Glanbia Plc

Danone S.A.

Nestlé S.A.

Key Industry Developments

January 2024: Zingavita raised USD 1.2 million in pre-series A funding.

May 2023: Kirin Holdings partnered with Kellogg’s to launch All-Bran products in Japan.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()