Europe and Asia Pacific are anticipated to witness a notable market growth in the coming years. During the forecast period,

PUNE, MAHARASHTRA, INDIA, February 3, 2026 /EINPresswire.com/ — The maritime satellite communication market size 2026 represents a rapidly evolving industry driven by technological advancement and increasing connectivity demands across global shipping operations. According to Fortune Business Insights, the market demonstrates substantial growth potential as maritime operations embrace digital transformation.

Get a Free Sample PDF – https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/maritime-satellite-communication-market-113315

Market Overview and Projections

The worldwide maritime satellite communication industry achieved a valuation of $4.5 billion in 2025 and is projected to expand from $5.0 billion in 2026 to $11.8 billion by 2034. This growth trajectory reflects a compound annual growth rate of 11.42% throughout the forecast period, indicating robust sector expansion driven by multiple converging factors.

Maritime satellite communication encompasses voice, data, and video connectivity between vessels, offshore installations, and shore-based facilities through geostationary, medium Earth orbit, and low Earth orbit satellite networks. The technology supports diverse applications including navigation assistance, operational management, regulatory compliance monitoring, crew welfare programs, and enhanced safety protocols.

Primary Growth Catalysts

The sector’s expansion stems primarily from widespread adoption of Very Small Aperture Terminal technology, which delivers high-bandwidth internet connectivity supporting real-time data transmission, video conferencing capabilities, and Internet of Things monitoring systems. VSAT solutions enhance operational efficiency while improving crew welfare and safety standards aboard vessels. The technology’s integration with cloud platforms and bandwidth optimization capabilities strengthens its role in navigation systems, remote maintenance operations, and shipping logistics coordination.

The digitalization wave sweeping maritime operations creates substantial opportunities as autonomous vessel development accelerates. Real-time data requirements for navigation, cargo tracking, and predictive maintenance drive demand for fast, reliable sea-based connectivity. The convergence of 5G technology with advanced satellite systems, including multi-frequency antennas and gyro-stabilized terminals, enables enhanced coverage and superior communication quality. As international maritime commerce expands and environmental monitoring regulations intensify, service providers can capitalize on scalable, data-driven communication solutions.

Technological Evolution

High-Throughput Satellite technology represents a significant advancement in maritime communications. HTS improves spectral efficiency through spot beam technology, concentrating signals on specific geographical areas to deliver substantially greater bandwidth. This enables maritime operators to access data-intensive services including cloud computing, advanced navigation systems, and video streaming capabilities even in remote oceanic regions. The technology provides cost-effective internet services with reduced latency, essential for real-time decision-making and operational optimization aboard vessels.

Get a Free Sample PDF – https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/maritime-satellite-communication-market-113315

Market Obstacles

Cybersecurity threats present severe challenges to market expansion. Satellite communication networks face increasingly sophisticated attacks including phishing schemes, ransomware, malware infiltration, and distributed denial-of-service assaults, threatening critical shipboard communications and exposing vulnerabilities to data breaches. These security concerns compromise data integrity and operational safety, necessitating substantial investments in advanced protection solutions. Implementation complexity and high costs associated with robust security measures discourage some maritime operators from infrastructure modernization, restricting broader technology adoption.

Regulatory compliance creates additional complications. Multiple and evolving national regulations across jurisdictions create complex operational environments for satellite service providers, particularly those serving international waters. Spectrum allocation challenges and cross-border compliance requirements complicate operations and delay service launches. Varying standards for data privacy, security protocols, and environmental impact necessitate continuous system upgrades. These regulatory obstacles increase costs and complicate integration of emerging technologies for providers maintaining global connectivity.

Regional Market Dynamics

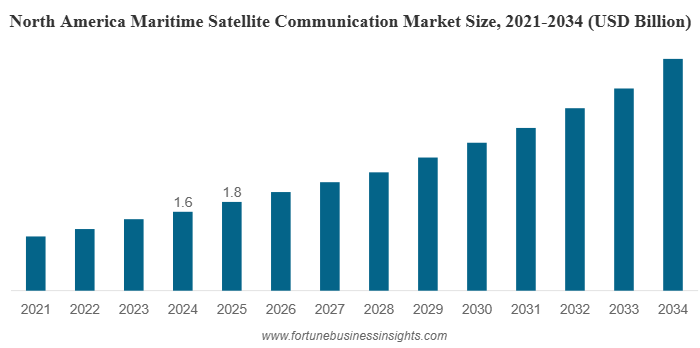

North America maintained market dominance in 2024 with a valuation of $1.6 billion, advancing to $1.8 billion in 2025. The region’s growth stems from increased maritime traffic, demand for high-speed connectivity, advanced naval operations, and rapid adoption of technologies including high-throughput satellites and low Earth orbit constellations. Military requirements for secure communications and expanding Internet of Things device deployment drive U.S. demand, with the American market projected to reach $1.2 billion in 2026.

Asia Pacific demonstrates the highest regional growth rate at 12.16% CAGR during the forecast period. Expansion drivers include increasing seaborne trade volumes, enhanced focus on maritime safety and security, digital transformation initiatives, and development of high-speed satellite broadband and low Earth orbit constellation technologies. China anticipates reaching $0.4 billion, Japan $0.2 billion, and India $0.4 billion in 2026 valuations.

Europe’s market is estimated at $1.0 billion in 2026, driven by the region’s significant shipping sector and demands for improved crew welfare programs. Both the United Kingdom and Germany project individual valuations of $0.3 billion in 2026.

Market Segmentation Insights

Very Small Aperture Terminal broadband solutions captured the largest type segment share in 2025, reflecting rising data demands from route optimization, real-time performance monitoring, crew welfare applications, and cloud-based services at sea. Hybrid and multi-band packages demonstrate the highest projected growth at 11.64% CAGR.

Hardware components dominated the component segment in 2025 due to increasing demand for reliable and sophisticated antennas, modems, and stabilization systems essential for continuous maritime communications. Software solutions exhibit the strongest growth prospects at 11.87% CAGR.

Connectivity services held the dominant service segment position in 2025, addressing critical needs for reliable, high-speed, continuous global communication supporting operational efficiency, safety protocols, regulatory compliance, and crew welfare. Tracking and monitoring Internet of Things applications show the highest growth potential at 12.18% CAGR.

Fleet operations and ship management applications led the application segment in 2025, driven by stricter emissions standards, reporting requirements, and safety regulations dependent on real-time shore-to-ship data flows. Remote maintenance and diagnostics applications project the highest growth rate at 12.24% CAGR.

Merchant and commercial shipping dominated end-user segments in 2025, propelled by expanding global trade, larger digitalized fleets, and operational expense control requirements through data-driven decision-making. Defense and government sectors demonstrate the strongest growth trajectory at 12.10% CAGR.

Get a Free Sample PDF – https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/maritime-satellite-communication-market-113315

Competitive Landscape

Leading market participants including Inmarsat Global Limited, Iridium Communications, Leonardo, Thuraya Telecommunications, and ViaSat drive innovation across broadband and narrowband services. The SES and Intelsat merger created a formidable multi-orbit satellite operator enhancing global coverage and bandwidth capabilities. SpaceX’s Starlink introduces high-speed connectivity alternatives with improved cost efficiency, compelling traditional providers to adopt multi-orbit and hybrid approaches. Market leaders emphasize cybersecurity enhancements, managed service offerings, and regional expansion, particularly across Asia Pacific markets, capitalizing on growing maritime trade and autonomous vessel applications.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()