The valve seat inserts market is projected to grow from USD 6.9 billion in 2026 to USD 10.1 billion by 2036, at a CAGR of 3.9%.

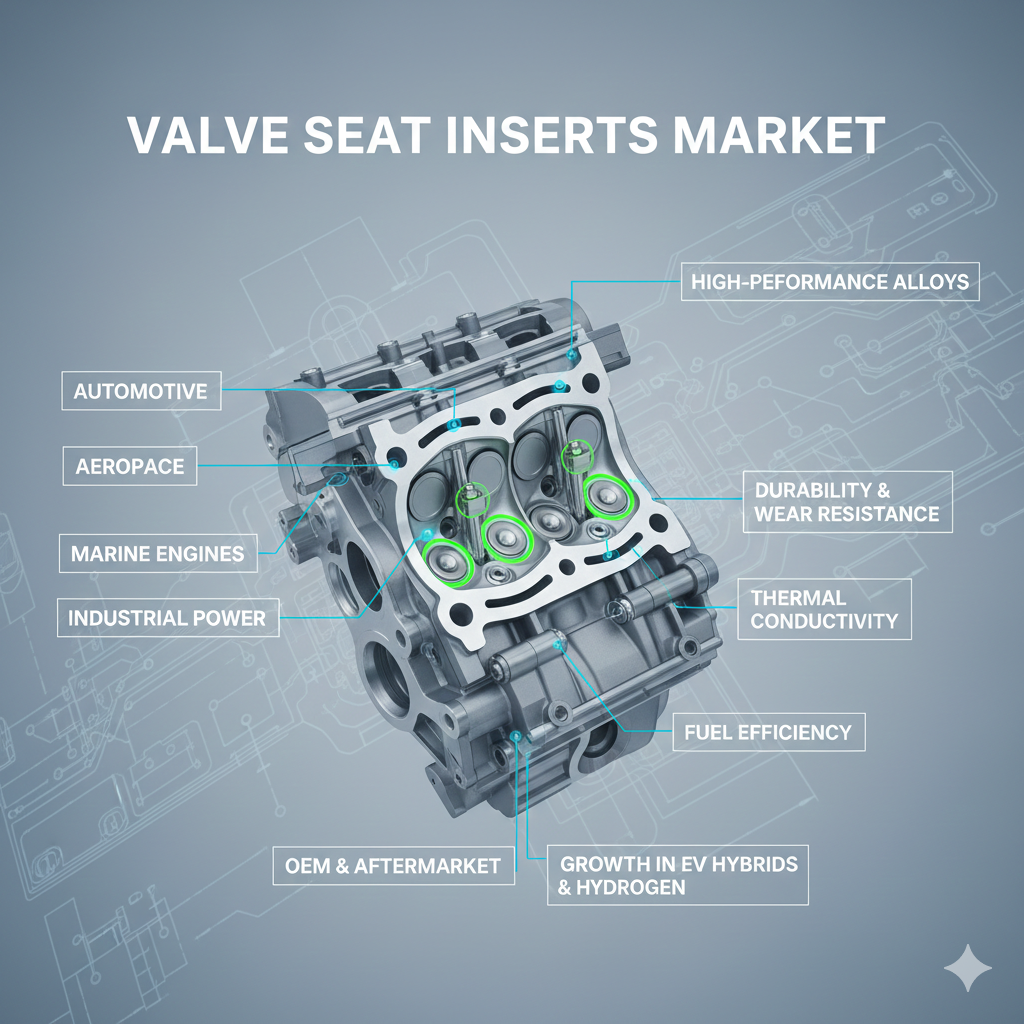

NEWARK, DE, UNITED STATES, February 5, 2026 /EINPresswire.com/ — The global valve seat inserts market is entering a pivotal era of material innovation and strategic recalibration, projected to grow from USD 6.9 billion in 2026 to USD 10.1 billion by 2036. This growth, representing a steady compound annual growth rate (CAGR) of 3.9%, is increasingly dictated by the dual pressures of stringent global emission standards and the demand for unprecedented engine durability across the automotive, aerospace, and industrial sectors.

The Material Revolution: Alloy-Based Solutions Lead the Way

As internal combustion engines (ICE) and specialized turbine architectures evolve to operate under higher thermal and mechanical stresses, the choice of material has become a primary competitive differentiator. Alloy-based valve seat inserts currently lead the market with a 38% share, favored for their superior strength, heat dissipation, and wear resistance.

While iron alloys remain a staple for cost-effectiveness, the industry is witnessing a decisive shift toward high-performance materials:

• Nickel and Cobalt-Based Alloys: Gaining traction in heavy-duty and high-performance applications where “hot hardness” and corrosion resistance are non-negotiable.

• Powder Metallurgy (PM) Advancements: Sintered materials are increasingly replacing traditional casting, offering more consistent metallurgical properties and the ability to incorporate specialized lubricants directly into the metal matrix.

• Ceramic Matrix Composites: Representing the cutting edge of the market, ceramic-reinforced inserts are being explored for next-generation engines to provide extreme thermal stability.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-7258

Aerospace and Automotive: The Dual Engines of Demand

The Aerospace sector has emerged as the most critical end-use segment, capturing 28% of the market share. The sector’s relentless pursuit of fuel efficiency and longer service intervals necessitates valve seat components that can withstand the extreme pressure environments of modern jet engines and auxiliary power units.

Simultaneously, the Automotive segment remains a high-volume driver. Despite the rise of electrification, the demand for advanced ICE and hybrid powertrains continues to grow in emerging economies. Manufacturers are under intense pressure to optimize combustion cycles, which requires tighter sealing and more durable seating surfaces than ever before.

Regional Spotlight: India’s Rapid Industrial Ascension

In a significant geographic shift, India has been identified as the key growth region for the forecast period. Driven by a massive expansion in domestic vehicle production and a burgeoning aerospace manufacturing hub, India’s market is set to expand at a 4% CAGR—outpacing the global average.

Other high-potential regions include:

• China (3.8% CAGR): Maintaining its status as a manufacturing powerhouse with a focus on high-efficiency gasoline and hybrid engines.

• Brazil (3.6% CAGR): Seeing a resurgence in industrial machinery and heavy-duty transport requirements.

• USA (3.4% CAGR): Driven by high-performance vehicle demand and rigorous aerospace standards.

Commercial Dynamics and Strategic Execution Risks

For senior leadership and investors, the next decade presents a landscape of both opportunity and volatility. The market report highlights that volume predictability remains a persistent challenge. Suppliers must balance the need for capital-intensive precision machining with a supply chain that can adapt to sudden shifts in end-market production schedules.

“Pricing discipline will be the defining trait of market leaders over the next ten years,” notes the analysis. “With buyer leverage at an all-time high, the ability to manage raw material price fluctuations—particularly for high-grade nickel and cobalt—while maintaining quality standards will separate the dominant players from the rest.”

Competitive Landscape and Key Players

The competitive arena is dominated by established giants and precision-focused specialists, including MAHLE GmbH, Federal-Mogul LLC, Nippon Piston Ring Co., Ltd., and Dura-Bond Bearing Company. These organizations are increasingly turning to Industry 4.0 and automated inspection systems to meet the “zero-defect” requirements of modern OEMs. Strategic mergers and acquisitions, such as the recent consolidation of specialized alloy producers, indicate a trend toward vertical integration to secure material supplies and proprietary metallurgical formulas.

Similar Industry Reports

Japan Valve Seat Inserts Market

https://www.futuremarketinsights.com/reports/demand-and-trends-analysis-of-valve-seat-insert-in-japan

Korea Valve Seat Insert Market

https://www.futuremarketinsights.com/reports/demand-and-trends-analysis-of-valve-seat-insert-in-korea

Automotive Valve Seat Insert Market

https://www.futuremarketinsights.com/reports/automotive-valve-seat-insert-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()